Families for Economic Security

Achieving a Livable Income for Everyone

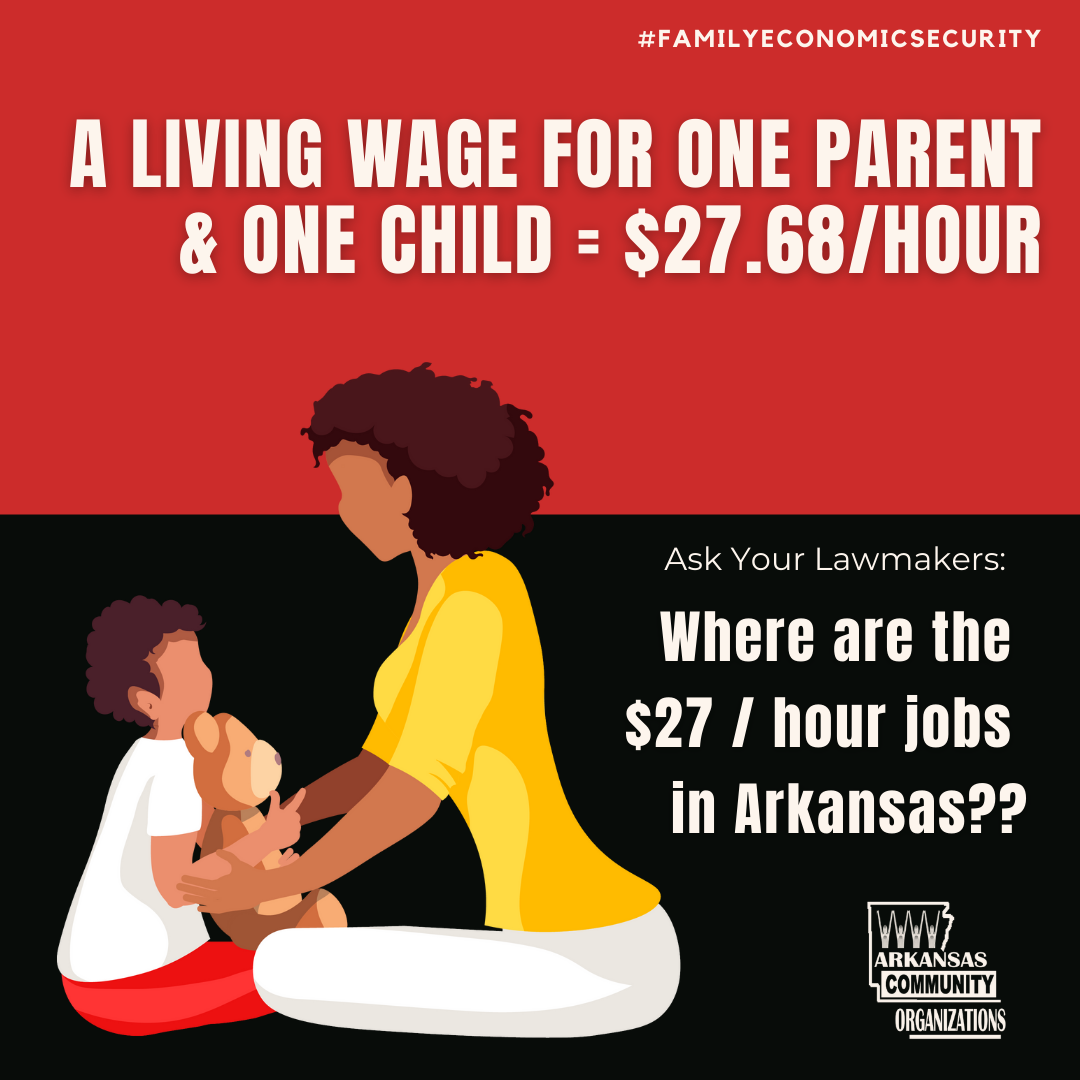

The Arkansas minimum wage is $11 an hour. That’s a far cry from a livable wage. For a family with two working parents and two children, a livable wage would need to be close to $20/hour to comfortably cover food, child care, medical expenses, housing and transportation. A single working parent with two children would need to make $34/hour to make ends meet for their family. Where are the $34/hour jobs in Arkansas?

This is what many of our current lawmakers just don’t get. Low-income families simply don’t have access to jobs that pay enough to cover rent, meals, child care, healthcare and transportation.

We believe:

Every Arkansas should be able to count on an income that covers basic living expenses.

No one should struggle to cover their housing, food or medicine costs due to debt burdens.

Debt Relief Campaign

From the emergency room to the court room, medical debt and court costs are trapping thousands of Arkansans in debt cycles. Did you know that some 37% of Arkansans carry medical debt, and 20% have medical debt in collections? If you do, you are not alone.

Even if you don't have debt yourself, debt burdens affect us all because household financial insecurity affects cities and our communities. After an income disruption, financially insecure households are much more likely to:

be evicted

miss a housing payment

miss a utility payment

Actions You Can Take

Sign up for email updates from our Families for Economic Security Community. Check boxes for “Debt Relief” and/or “Livable Incomes”.

Read the report: From the ER to the Courtroom, How Medical Bills and Court Costs Trap People in Debt Cycles

Become a member and support our work helping low-income folks improve their credit ratings.

ACO member Ms. Wanda Murry and organizer Demetrius Melvin talk about paying off debt and getting help with your credit record.

Read Our Reports on Debt.

-

From the Emergency Room to the Courtroom

Medical debt is overwhelming Arkansans, and the COVID-19 pandemic only increased the burden. Changes in federal and state regulations and how hospitals handle patients’ claims can relieve the strain on American families. Read our report with Asset Funders Network and Hope Policy Institute.

-

Can't Win for Losing

Close to 40% of Arkansans have debt in collections. And low-income Arkansans bear the greatest debt burden.

58% of Black and Brown households have debt in collections compared to 36% of White households.

What can we do about this? In 2018, we asked 1,845 Pulaski and Jefferson County community members about their debt experience. Our report sheds light on how to ease debt burdens in three key areas: medical debt, student loans, and excessive court fines and fees.

-

Debt Details

You can download facts about people facing debt in Pulaski and Jefferson Counties, including stats on student debt, medical debt, average debt in collections and more. Check out these slides, compiled from our “Can’t Win for Losing” report on Arkansans in debt.